Payment processing in Africa has experienced a profound evolution over the years, driven by technological innovations, economic development and the growing need for efficient and convenient payment methods. Recently, new opportunities to secure transactions have been introduced addressing evolving needs for advanced financial services.

In the early days, Cash and Barter was prominent, and for centuries, the primary means of exchange in Africa remained cash and barter systems. In local markets and villages, transactions were often conducted through the direct exchange of goods and services, with cash serving as a supplementary method for everyday trade in many communities.

However, with economic growth and increasing urbanization, the use of checks and money orders emerged, particularly in urban areas. These payment methods provided a more formal and organized approach to facilitate larger transactions, moving beyond the basic cash and barter systems.

The Rise of Electronic Payments

The late 20th century introduced a transformative innovation in banking with the rollout of Automated Teller Machines (ATMs). This transformed banking by enabling individuals have access to their funds quickly, conveniently and securely. Alongside the rise of ATMs, debit and credit cards began to reshape the financial landscape across Africa. The increased acceptance of card payments helped accelerate the shift towards a more cashless economy.

The Mobile Revolution

In 2007, Kenya’s M-Pesa transformed the way people handle money, ushering in a new era of mobile payments in Africa. With the use of mobile phone people have access to send and receive money, pay bills, and purchase goods effortlessly.

Following M-Pesa’s success such as MTN MoMo in South Africa and Airtel Money in Nigeria offers similar services and drive financial inclusion for underserved communities across the continent. These services have empowered people to participate more fully in the economy and contributing to Africa’s growing digital system.

The Growth of Digital Payments

Online payments are taking charge because of their revolutionized way of conducting financial transactions. Platforms such as PayPal and Payoneer have become essential for managing international payments which offer a seamless and secure way to handle cross-border transactions.

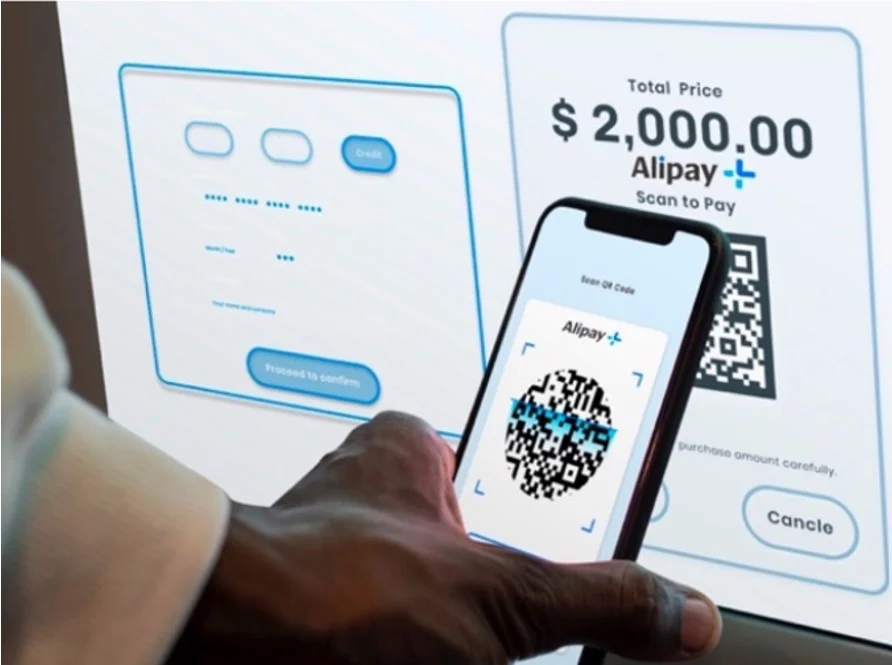

Some African countries with strong economic connections to China have seen explosive growth in mobile payment apps like Alipay and WeChat Pay. These apps enable users to make payments directly from their smartphones.

QR codes also serve as a game-changer in payment methods in many African countries allowing quick and contactless transactions for customers. This technology allows users to complete transactions by scanning a code with their smartphones, making payments faster and more secure.

Challenges and Opportunities

In many regions, unreliable power supply and limited internet connectivity can hinder the adoption of digital payment solutions. Investing in a better internet access and more reliable power supplies will help build a strong digital payment system.

Also, ensuring that everyone has access to financial services, including payment options, remains a challenge in many African countries, and to improve financial inclusion, solutions like mobile banking and community-based financial services are being developed.

In addition, safeguarding customer data and preventing fraud has become a top priority for payment processors and financial institutions. This will help to maintain trust and integrity in the digital payment system.

Despite these challenges, the future of digital payment processing in Africa looks promising. As technology continues to advance and economies grow, we can anticipate further innovation and expansion in the digital payment landscape.