For years, card payments have held the crown as the go-to method for digital transactions. But in recent times, a new conversation is taking center stage: Are card payments losing their edge? With the rise of real-time bank transfers, mobile wallets, and QR-based transactions, the future of payments seems to be rewriting itself in real time.

At Woven Finance, we believe that this shift isn’t just coming; it’s already here. And we’re building for it.

A Global Perspective: Cards Are Evolving

In developed markets, card usage remains dominant, but not untouched, and the explosion of digital wallets and contactless payments has changed how people interact with their cards. Rather than swiping or inserting them, users now store cards in apps like Apple Pay and Google Pay, adding layers of convenience and security.

Still, while cards are adapting through tech overlays, real-time payments are rapidly gaining favor. Customers are looking for instant, direct ways to move money, without the delays, intermediaries, or friction.

The African Reality: Mobile-First, Trust-Driven

In Africa, the story takes a bold twist. Here, mobile money is king, especially in underserved or underbanked regions. Services like M-Pesa, MTN MoMo, and Opay have drastically widened access to digital payments. And where infrastructure or trust in cards is low, these alternatives thrive.

That said, cards are not disappearing. In urban centers and across sectors like e-commerce and logistics, POS terminals still dominate. But even there, consumer patience with card failures and delays is wearing thin, and faster, more reliable bank-to-bank payments are gaining traction?

The Future of Seamless Payments

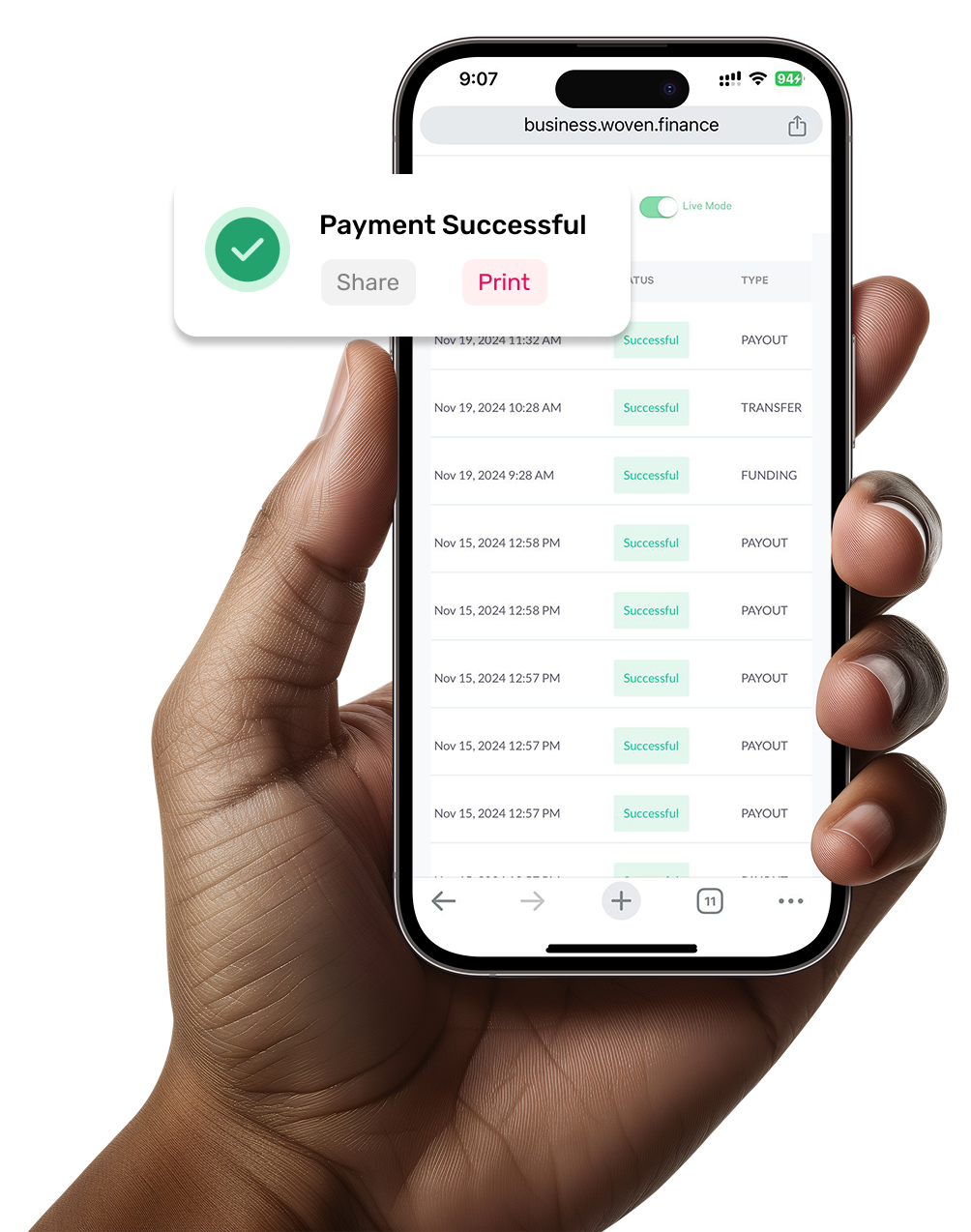

This is exactly where Woven Finance is placing its biggest bet: on real-time, low-friction payments that work wherever and however your customers want to pay.

Here’s how Woven is addressing the shift beyond cards:

Pay by Transfer: Our transfer feature lets customers directly make payments, no card required. It’s fast, trusted, and eliminates the usual friction tied to card declines or network errors.

Smart, Shareable Payment Links: Woven lets you generate custom payment links you can send via WhatsApp, DMs, email, anywhere your customers are. They pay, you get settled.

QR Payments: We make in-person transactions effortless with QR payment options that allow customers to scan and pay instantly, a seamless flow from interest to payment in seconds.

Direct Debit for Recurring Payments: This feature isn’t here yet, but with Woven Direct Debit, businesses are sure to get paid on schedule, automatically ideal for subscriptions, memberships, or rent.

Transparent Fees and Seamless Reconciliation: One of the major complaints around cards is unclear fees and slow settlement. Woven flips that on its head with transparent pricing, smooth settlement, and a dashboard that gives you total control.

So, Are Card Payments Really Declining?

Not exactly. They’re being repositioned. They now serve more as a gateway than a destination, often embedded inside wallets or digital rails. But what’s clear is this: Consumers and businesses alike are demanding faster, simpler, and more direct ways to pay.

And in Africa, where speed, trust, and flexibility matter most, solutions like Pay by Transfer are winning ground.

At Woven Finance: We’re Not Just Watching the Shift. We’re Building for It.

At Woven Finance, we’re not waiting for change, we’re engineering it. Whether it’s reducing dependence on cards, enabling smarter bank transfers, or providing tools that put merchants in control, our mission is clear: make payments seamless for everyone.

The future of payments won’t belong to any one method. It’ll belong to whoever makes it seamless. And that’s where we’re focused.

Ready to step into the future of payments?

Visit woven.finance to explore smarter solutions built for how Africa really transacts.