Virtual Accounts

Running a business can be tricky, especially when money is coming in from different places, but Woven Finance’s Virtual Accounts make it super easy!

Think of a Virtual Account like having different “kolo” for different types of money, but instead of physically saving cash, it helps you receive and track payments automatically. For example, imagine you run a food business and sell both jollof rice and small chops. Instead of collecting all your money in one place and later trying to figure out who paid for what, you can create different virtual accounts: one for customers ordering jollof rice, another for small chops orders, and then a separate one for bulk catering payments.

So, when someone sends you money, you immediately know what the payment is for and who sent it, no mix-ups, no stress!

With Woven Finance’s Virtual Accounts, you don’t need to manually check bank statements or chase customers for payment details. It’s like having a trusted shopkeeper who keeps track of all your payments instantly and accurately, so you don’t have to stress.

QR Payments

With Woven Finance’s QR Code Payments, all you need to do is display your QR code at the counter. A customer simply scans it with their phone, enters the amount, confirms the payment, and in seconds, they receive the money.

No need for POS machines, no network delays, and no back-and-forth checking for bank alerts. Transactions are seamless, and your customers leave happy.

Business owners across Nigeria, from market traders to high-end boutiques, are switching to QR codes because they give speed, accuracy, and convenience. So, no matter the kind of business you run, QR codes make getting paid effortless.

Card Payments

Customers expect convenience, and card payments provide just that. When someone shops at a supermarket or dines at a restaurant, they simply insert, tap, or enter their card details, and the payment is processed instantly, and your business can offer the same ease with Woven Finance’s Card Payment Solutions.

Card payments allow customers to pay using Visa, Mastercard, and Verve cards, anytime, anywhere, with secure and instant processing, even when bank apps are down. For businesses looking to scale, accepting card payments increases credibility and trust.

Customers feel safer shopping with businesses that provide multiple payment options. No matter your business, card payments help you grow faster while making checkout easy for everyone.

Payment Links

You don’t need a website or a POS machine to receive payments. If you’re selling products on Instagram, offering professional services, or running a coaching business, you need a quick and reliable way for customers to pay you. This is where Payment Links come in.

With Woven Finance, you can generate a unique payment link for each transaction. Simply send the link to your customers via WhatsApp, Instagram, email, or even SMS. They click, enter their payment details, and the money reaches your account instantly.

No stress, no confusion. It’s just like having a checkout page without needing a full website. Payment Links allow you to complete transactions smoothly, and customers love the simplicity, so you never have to worry about losing a sale due to complicated payment processes.

Pay Outs

Managing business payments shouldn’t be stressful, but for many entrepreneurs, it often is since the traditional way of making bank transfers one by one can be time-consuming and full of errors.

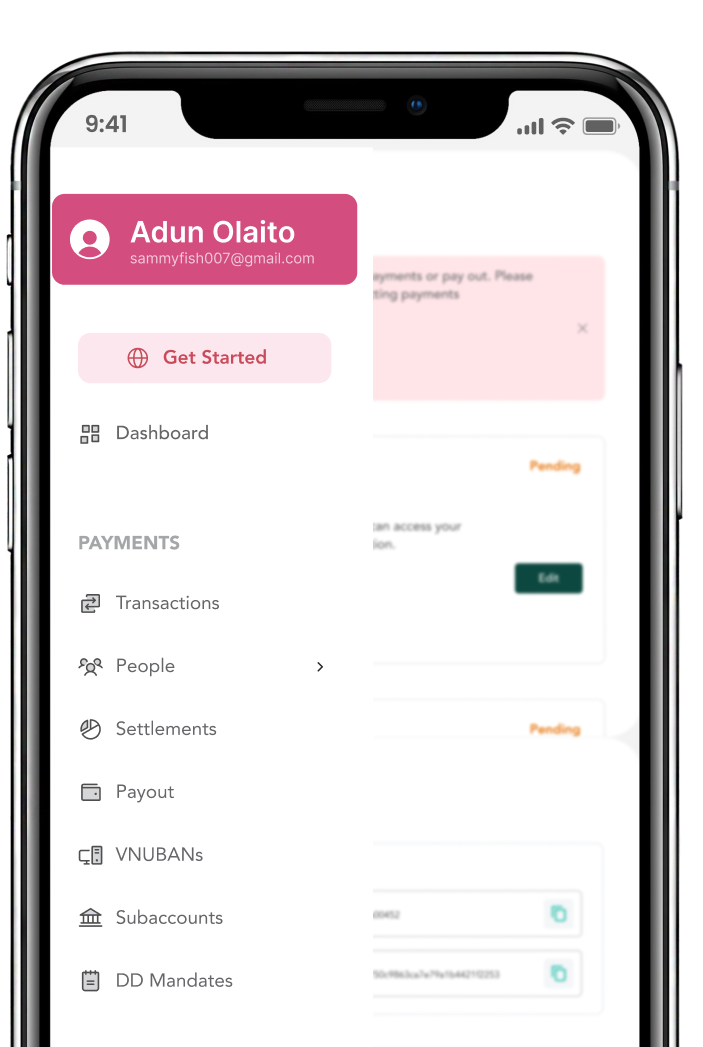

With Woven Finance’s Payouts, you can send money to multiple people at once, all from a single dashboard. No checking and rechecking account numbers or dealing with failed transfers. Instead, payments are processed instantly, and every transaction is recorded automatically for easy tracking.

So, imagine you own a logistics company with 20 delivery riders who need to be paid at the end of the week. Instead of making 20 separate transfers, you can simply upload their details, enter the amounts, and process everything in one click. It’s fast, seamless, and error-free, helping you manage your finances efficiently while keeping your team and partners happy.

Direct Debits

Every business owner knows how frustrating it is to chase after payments. Customers forget, bank apps fail, and invoices get ignored. If your business runs on subscriptions, installment plans, or regular billing, missed payments can disrupt your cash flow.

With Direct Debit, you no longer have to send reminders or wait for customers to make transfers as payments are automatically deducted from their accounts on a set date, ensuring you get paid on time, every time.

Think about how your Netflix or electricity bill gets deducted without you having to do anything. Now, your business can offer the same convenience, ensuring that payments happen seamlessly without delays or excuses.

Customers also benefit because they don’t have to remember due dates or go through the hassle of manual payments. Everything is automated, secure, and transparent, and if you want to guarantee consistent revenue while giving your customers an effortless payment experience, direct debit is the solution you need.